Ethereum raises gas limits for first time, a move that could make transactions faster and cheaper. This is the first time since 2021 that Ethereum has increased these limits, aiming to improve network efficiency and appeal to more users.

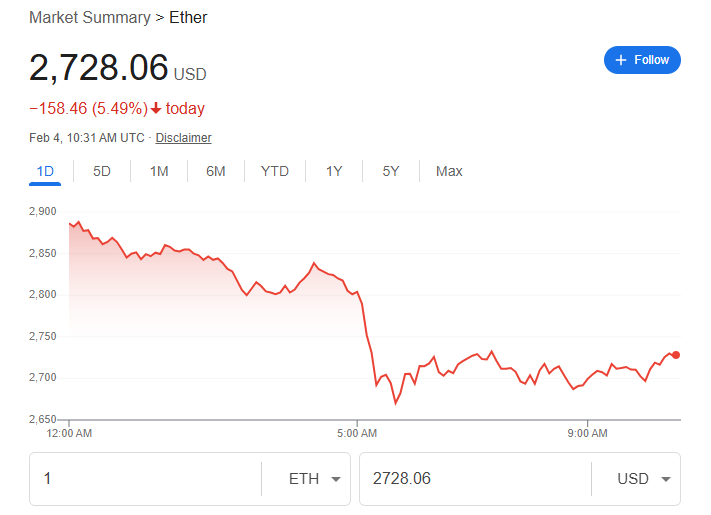

Ethereum Price Drops Amid Market Turbulence

Ethereum, the second-largest cryptocurrency by market cap, fell sharply to $2,368 on Monday. The drop followed new tariff announcements by U.S. President Donald Trump. At the time of writing, Ethereum is trading at $2,544, marking a 17.8% daily loss, according to CoinGecko.

The entire crypto market saw heavy liquidations, with Ethereum leading the losses. Over $2.3 billion in positions were liquidated across 738,000 traders in just 24 hours, per CoinGlass. Ethereum accounted for $611 million in liquidations, with long traders suffering the most.

Bybit CEO Ben Zhou suggested the actual liquidation amount could be between $8 billion and $10 billion. Zhou claims exchanges limit liquidation data, meaning reported numbers may be lower than reality.

Ethereum’s Underperformance Against Bitcoin

ETH has struggled more than Bitcoin and other major cryptos like Solana (SOL) and Binance Coin (BNB). Analyst Min Jung from Presto Research notes that Ethereum has been one of the least popular trades this cycle. The ETH/BTC ratio has continuously hit new lows.

Concerns about leadership at the Ethereum Foundation and its institutional shift through projects like Etherealize may have also hurt investor sentiment. This adds to Ethereum’s underperformance compared to other major cryptocurrencies.

Ethereum’s decline is the largest single-day drop since May 2021. Back then, ETH fell from its all-time high of $4,308 to $2,200 in just one week. Currently, Ethereum is still about 48% below its peak of $4,878 in November 2021.

Market Volatility Surges

Ethereum’s one-day at-the-money volatility jumped from 34% to 184%. The Deribit ETH DVOL index, which tracks expected price swings over four weeks, surged from 67% to 101%.

Traders panicked, rushing to hedge risks. The put-call ratio spiked from 0.6 to above 2.5. A dormant whale moved $228.6 million worth of ETH to Bitfinex before the crash, possibly adding to the selling pressure.

Despite Bitcoin dropping only 4.7% to $94,438, Ethereum’s steeper fall highlights its vulnerability in uncertain markets. The crypto market’s fear and greed index now stands at 44, signaling “fear.” Historically, this has been a time when some investors buy the dip.

Tariffs and Economic Uncertainty Impact Crypto

The crypto crash follows Trump’s announcement of 25% tariffs on Canada and Mexico and 10% on China. Analysts believe these tariffs could increase inflation and make it harder for central banks to lower interest rates.

Finance market participants had expected these tariffs but were focused on other industry controversies. 10x Research noted that the market underestimated the potential backlash from foreign governments.

Traditional markets also reacted negatively. Dow futures fell more than 650 points on Monday, and European stocks followed. Meanwhile, the U.S. dollar gained strength.

Future Outlook

Jeff Park, head of alpha strategies at Bitwise, compared the situation to the 1985 Plaza Accord. That agreement aimed to weaken the U.S. dollar to reduce trade imbalances. If similar policy moves occur now, they could impact both crypto and fiat currencies.

For now, Ethereum’s future depends on how traders react to these economic shifts. If history repeats itself, the current fear in the market could turn into an opportunity for long-term investors.